From our blog

Build Your Credit

With responsible handling of your account you can build your credit history.

Sign Up in Minutes

Applying for your card is quick and painless. You will immediately receive your approval decision.

Start Spending

Start using your credit card as soon as it's mailed to you.

Credit Card Offers

Fix Your Credit

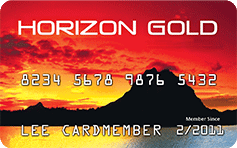

Horizon Gold Credit Card

Complete our easy application and your results will be ready immediately. When approved you will have access to your $500 credit line along with other benefits.

| Annual Percentage Rate for Purchases: | 0.00% |

|---|---|

| Variable Rate Information: | N/A |

| Grace Period for Repayment of Balances for Purchases: | N/A |

| Method of Computing the Balance for Purchases: | Revolving |

- Bad Credit, No Credit? No Problem!

- Icon Reports to Major Credit Bureau

- Icon $500 Credit Limit

- Icon Fast and Easy Application

- Icon No Employment or Credit Check

Group One Platinum Credit Card

Apply for the 0% interest rate card that will help you build your credit again. This card will properly teach you how to use a credit card to build back your credit and keep it in good standing. Click the link and complete the form to get more information.

| Annual Percentage Rate for Purchases: | 0.00% |

|---|---|

| Variable Rate Information: | N/A |

| Grace Period for Repayment of Balances for Purchases: | N/A |

| Method of Computing the Balance for Purchases: | Revolving |

- Boost Your Credit

- Reports from Major Credit Bureau

- $500 Credit Limit

- Pay Off Immediately to Improve Score

Fix Your Credit

Look for Credit Cards that will help build or rebuild your credit. With only $500 credit limit, you can control you budget and pay off the card immediately.

Once you get a credit card, you can build credit by using it every month, paying off your purchases on time and keeping a low credit utilization (less than 30%). But there are many ways to build credit with a credit card other than making purchases and payments. For instance, you could lock your credit card in a drawer, and your score would still improve.

The key, regardless of your exact approach, is to get a credit card as soon as possible and then avoid missing due dates. Simply having an open credit card account is the easiest way to build credit. And payment history is the biggest ingredient in your credit score. With that being said, we’ll lay out our ideal approach to building credit with a credit card above.

Keys to Building Credit with a Credit Card

- Pick the Right Credit Card. It’s important to do research before you apply. Consider your needs, then compare the terms of cards that cater to those needs. You can use WalletHub’s credit card comparison feature to help.

- Always Pay On Time. Missing a payment is one of the worst things you can do to your credit. A good payment history is essential for future approvals and credit limit increases, so make sure to always make at least the minimum payment before it’s due.

- Pay In Full Whenever Possible. Paying just the minimum required will keep your account in good standing, but it won’t save you on interest. Paying in full by the due date does, though. And you don’t want to get in the habit of spending more than you can afford to repay.

- Don’t Max Out Your Limit. Using more than 30% of your credit risks damage to your score. 1%-10% utilization will help your score the most. And, of course, don’t spend beyond your means, regardless of what our limit is.

- Check Your Credit Score & Report Regularly. You can check your latest credit score and report for free on WalletHub. This will help you make sure you stay on the right path. It also allows you to catch errors on your report and dispute them, which can help your score.

News

Why Bad Credit Loans Are Popular

Since the early 2000’s, payday loans, otherwise known as bad credit loans, have been a controversial topic for everyone. While a lot of people do not agree with the loans, and think it’s digging people further into debt, some people simply don’t have any other options. So why do so many people turn to payday…

6 Steps to Lower Your Credit Card Debt!

This year has been a roller coaster economically for the world. It has shown us that we need to be prepared for anything. Unfortunately, debt is something in reality to worry about as well. With unemployment at it’s highest it’s been in decades, it forces a rising amount of citizens to use their credit cards…

Fast Easy Debt Relief – $10k+ Credit Card Debt Program

U.S. Rise in Debt In 2019, we experienced a high volume of consumers with high amounts of Credit Card Debt (over $10,000). We also experienced something similar to to 2008 financial crisis in terms of the amount of debt that has been piling up. 2020 is now continuing this pattern, with the shutdowns across the…